There are many anecdotes about wealthy foreigners seeking to buy ‘bolt-holes’ in New Zealand to escape the real and potential problems in the Western World. New Zealand is arguably one of the most beautiful and safest places in the World and has been consistently ranked as having one of the least corrupt public sectors and judiciaries in the World. In 2017 the capital city of Wellington was ranked the best place to live in the world in a global Deutsche Bank study of 47 cities.

There is a perception that following the changes in 2018 to N.Z’s Overseas Investment Act the door has now been shut on foreigners buying in New Zealand. While that is partly true there are still many opportunities within current N.Z. law for foreigners to acquire their own little slice of paradise.

Not a total ban

The Overseas Investment Act 2005 (OIA), subject to certain exemptions, brings ‘residential land’ into the definition of ‘sensitive land’. This means that the acquisition of residential land by overseas persons now requires the consent of the Overseas Investment Office (OIO). With some exceptions for Australian and Singaporean citizens, anyone who is not a New Zealand citizen or is not ‘ordinarily resident’ in New Zealand, is an overseas person.

Sensitive land includes various types of land including residential land, non-urban land over 5 hectares, land which has frontage to foreshore and seabed, land on certain islands and land which has certain special characteristics.

Examples of properties that foreigners may still buy

While many residential properties now require consent, there are still other properties and businesses that are not covered by the Act. And they are still very affordable by international standards! Following is a cross-section of some current examples:

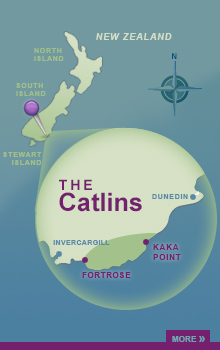

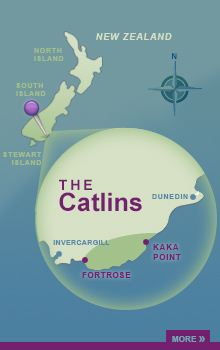

River Ridge Retreat is a slice of paradise in The Catlins – a relatively unspoiled and tranquil region in the South Island. The beautifully groomed grounds (freehold title) are bounded by the crystal clear Catlins River with a backdrop of rugged native bush-covered hills, stunning ridges, bird life, and the promise of abundant wildlife. Featuring a large, modern functions centre and a range of accommodation that sleeps up to 80 people this could suit a range of options including hunting & fishing resort, health and wellness retreat, eco-tourism resort, functions centre or just as your own private ‘bolt-hole’. Expressions of interest invited over USD$985,000

Omakau Commercial Hotel is a strategically located ‘trophy property’ adjacent to the iconic ‘Central Otago Rail Trail’ and only approx. 90 minutes’ drive to Queenstown or Wanaka. It was winner of the 2016 (and 2018 finalist) ‘Best Country Hotel’ in New Zealand. Set on a substantial land holding of 1.0170 hectares there is considerable scope for further development, including potential to construct additional units or houses (subject to council approval). There are options to purchase the freehold land and buildings only at approx. USD$920,000 with a 35year lease in place to the business, providing a net 7.0% return; or the freehold going concern at approx. USD$1,150,000.

Kuramea Holiday Park – this great property and business is located at Pounawea, a restful beach-side holiday community at the gateway to the Catlins and an increasingly popular tourist destination. It offers magnificent scenery, native bush, bush walks, bird life, wildlife, kayaking and fishing, peace & tranquility.

The facilities include approx 14 powered sites, 2 cabins, amenities block and recently renovated ‘flat’ split into two self-contained units – 3-bdrm and 4-bdrm that is permitted to sleep up to 17 guests. There is ample scope to grow the business, further develop the site and/or use as your private beach-side ‘bolt-hole’! Where else can you buy a property like this in such an idyllic location for only USD$430,000!

Grumpy’s Geraldine Kiwi Holiday Park – is a spacious 2ha (approx.) holiday park with substantial amenities including owner/manager’s home. It is only 6km/5min north of the Geraldine village and strategically positioned on the corner of state highways SH79 and SH72, the Christchurch to Southern Lakes Scenic Route, with prime exposure to tourist traffic. The area offers plenty of including attractive parks, reserves and walkways where visitors can tramp, bike, horse trek or feel the thrill of rafting on the Rangitata River.

The owner is planning his ‘retirement’ and has priced the freehold and business very realistically at USD$786,000.

If you wish to find out more about these opportunities, or just wish to make a general inquiry, then please feel free to contact the author.

Disclaimer: This article should not be implied as legal and/or immigration advice. You should obtain your own independent professional advice if you wish to explore any of the opportunities introduced in this article.

New Zealand has come through the recent GFC strongly and is poised for steady growth on the back of a relatively strong economy based primarily on agriculture (you can’t go wrong feeding the world!) and tourism. It is also a wonderful placed to invest, especially being recently ranked one of the world’s least corrupt countries and one of the easiest to do business in. And it has now been rated the World’s Most Socially Advanced Country as discussed in the following articles.

NZ Ranked World’s Most Socially Advanced Country

NZ Ranked #1 for Social Progress

New Zealand Commercial Property Investment – Minimum Investment NZD$50,000. Projected 8.75% cash return pa*.

Projected 8.75% cash return pa*. Farmers Building (Dunedin, New Zealand) Proportionate Ownership Scheme. Contact me if you’d like further information (including Investment Statement and Prospectus) sent to you.

Investors switch to real estate – New Zealand

Investors switch to real estate | Stuff.co.nz.

Contact me if you want to find out more about investing in N.Z. property – including commercial and university student rental property.

Walk along deserted sandy beaches, forest tracks, beside rivers and absorb the feeling of isolation and solitude. Visit areas where flocks of seabirds including Shags, Gannets and Shearwaters and occasionally penguins can be seen. Royal Spoonbills nest on one of the islands off the coast. Other spectacular attractions include the McLean Falls, the highest and arguably the most spectacular water-falls in the Catlins, and the Cathedral Caves, one of the largest sea caves complexes in the world. The area abounds with interesting native flora and fauna. It is one of the only places where Hoi Ho Penguins,

Walk along deserted sandy beaches, forest tracks, beside rivers and absorb the feeling of isolation and solitude. Visit areas where flocks of seabirds including Shags, Gannets and Shearwaters and occasionally penguins can be seen. Royal Spoonbills nest on one of the islands off the coast. Other spectacular attractions include the McLean Falls, the highest and arguably the most spectacular water-falls in the Catlins, and the Cathedral Caves, one of the largest sea caves complexes in the world. The area abounds with interesting native flora and fauna. It is one of the only places where Hoi Ho Penguins,